Global Investment Opportunities

Access international markets and diversify your portfolio with our curated selection of off-shore funds. Invest in global opportunities with confidence.

Why Invest in Off-shore Funds?

Global Technology Fund

BlackRock Investment Management

European Growth Fund

Fidelity International

Asia Pacific Dividend Fund

JP Morgan Asset Management

US Bond Fund

PIMCO Investment Management

Emerging Markets Fund

Vanguard Investments

Global Multi-Asset Fund

Schroders Investment Management

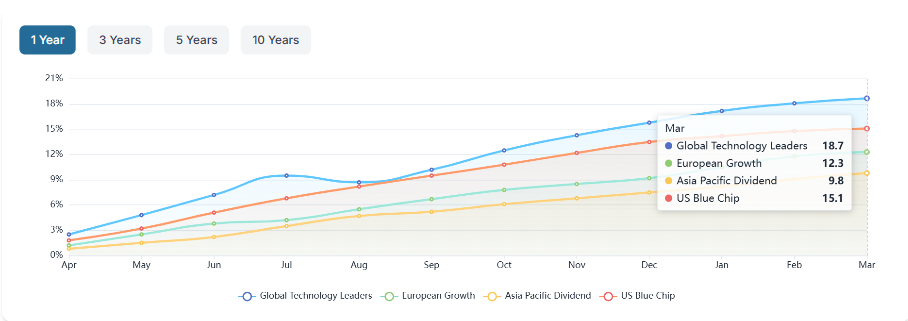

Performance Overview

Benefits of Off-shore Funds

Access international markets and reduce portfolio risk through geographic diversification across multiple economies and sectors.

Tap into high-growth regions and sectors that may outperform domestic markets, potentially enhancing overall returns.

Benefit from expert fund managers with specialized knowledge of international markets and regulations.

Frequently Asked Questions

Off-shore funds are investment funds domiciled in international financial centers outside your home country. They provide access to global markets and may offer tax advantages depending on your jurisdiction.

You can invest through our platform after completing KYC requirements and fund transfer procedures. Our advisors can guide you through the process and help select funds aligned with your goals.

Tax treatment varies by jurisdiction and individual circumstances. We recommend consulting with a tax advisor to understand the specific implications for your situation before investing.

Minimum investments typically start at $10,000 for most funds, though some premium funds may require higher minimums. We also offer periodic investment plans with lower entry points.

Ready to Explore Global Investment Opportunities?

Our investment advisors can help you build a diversified portfolio with off-shore funds tailored to your financial goals and risk tolerance.