Welcome to Aarthik Solutions

Discover High-Growth Opportunities with Specialised Investment Funds

What are Specialised Investment Funds (SIFs)?

SEBI’s Strategic Initiative

Introduced by SEBI to provide institutional-grade investment opportunities to High Net Worth Individuals (HNIs) and experienced investors, SIFs combine the regulatory oversight of mutual funds with the flexibility of PMS.

Why Were SIFs Introduced?

Traditional Investment Options

Mutual Funds (Low Entry )

• Minimum investment: ₹500

• Limited investment strategies

• Retail investor focused

• Standardized approach

Portfolio Management Services (High Entry)

• Minimum investment: ₹50 lakh

• Highly customized strategies

• Ultra HNI focused

• Complex compliance

SIF Fills the Gap

Perfect Middle Ground

Bridges the significant gap between mutual funds and PMS with ₹10 lakh minimum investment.

Enhanced Flexibility

Offers sophisticated investment strategies not available in traditional mutual funds.

SEBI Regulated

Maintains regulatory oversight and investor protection while offering advanced strategies.

Niche Opportunities

Access to specialized sectors like startups, fintech, and private equity investments.

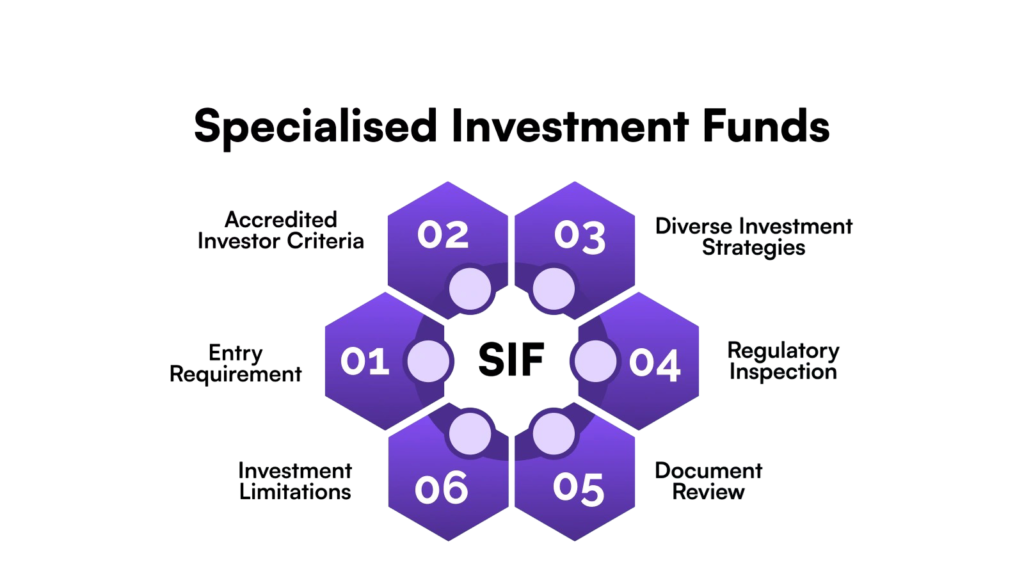

Key Features & Benefits of SIFs

₹10 Lakh Minimum Investment

Accessible entry point for HNIs and experienced investors seeking sophisticated investment opportunities.

Investment Strategy Flexibility

Dynamic portfolio management with ability to adapt strategies based on market conditions and opportunities.

Niche Sector Exposure

Access to specialized investments in startups, fintech, private equity, and emerging technology sectors.

Expert Fund Management

Managed by experienced professionals with deep market knowledge and proven track records.

SEBI-Regulated Framework

Complete regulatory oversight ensuring transparency, compliance, and investor protection.

Enhanced Return Potential

Opportunity for higher returns through sophisticated strategies and alternative investment options.

SEBI Guidelines for SIF Investments

Debt Investment Rules

- Maximum 100% allocation to debt securities

- Investment grade securities preferred

- Corporate bonds and government securities allowed

- Duration and credit risk management required

Allocation Limits

- Government Securities - Up to 100%

- Corporate Bonds - Up to 80%

- Money Market Instruments - Up to 20%

Equity Investment Guidelines

- Listed and unlisted equity securities allowed

- Startup and growth company investments permitted

- Sector concentration limits apply

- Due diligence requirements for unlisted securities

Investment Limits

- Listed Equity - Up to 100%

- Unlisted Equity - Up to 50%

- Single Company - Max 25%

REITs & InvITs Investment

- SEBI registered REITs and InvITs only

- Real estate and infrastructure exposure

- Regular income distribution expected

- Liquidity considerations important

Allocation Guidelines

- REITs - Up to 30%

- InvITs - Up to 30%

- Combined Limit - Max 50%

Derivatives Usage

- Hedging and risk management purposes only

- Exchange-traded derivatives preferred

- Strict position limits and monitoring

- No speculative trading allowed

Usage Limits

- Hedging Exposure - Up to 100%

- Currency Hedging - Permitted

- Speculative Trading - Prohibited

Who Should Invest in SIFs?

Experienced Market Participants

Investors with deep market knowledge and understanding of complex financial instruments.

HNIs & Institutional Investors

High Net Worth Individuals and institutions seeking diversified investment opportunities.

Sector-Specific Risk Takers

Investors comfortable with higher risk for potentially higher returns in specialized sectors.

You should consider SIFs if...

- You have ₹10 lakh or more available for investment

- You seek exposure to niche and emerging sectors

- You have a long-term investment horizon

- You understand market volatility and associated risks

- You want professional fund management with flexibility

- You're comfortable with moderate liquidity constraints

Why Aarthik Solution LLP?

Partnered with Top Brokers

Strategic partnerships with leading brokerage firms ensure competitive pricing and reliable execution.

Technical & Fundamental Research

Comprehensive market analysis combining both technical charts and fundamental company research.

Personalized Portfolio Guidance

Customized investment strategies tailored to your risk profile and financial objectives.

Support in Gujarati / Hindi

Local language support to ensure clear communication and better understanding of your needs.

Transparent & Long-Term Vision

Complete transparency in fees and processes with a focus on building long-term wealth.

Proven Track Record

Years of experience helping clients achieve their financial goals through smart equity investments.